In a world that can sometimes feel uncertain, it’s important to be prepared for any challenges that may come your way. That’s why understanding financial strategies for withstanding societal collapse is crucial. Whether it’s a global economic crisis or a natural disaster, having a plan in place can give you peace of mind and help you navigate through difficult times. In this article, we’ll explore some practical tips and tools that can help you safeguard your finances and ensure stability even in the face of societal collapse. From diversifying your investments to building an emergency fund, we’ve got you covered with strategies that are easy to implement and can make all the difference in maintaining financial security. So let’s get started and empower ourselves with the knowledge and tools we need to weather any storm that may come our way.

Invest in tangible assets

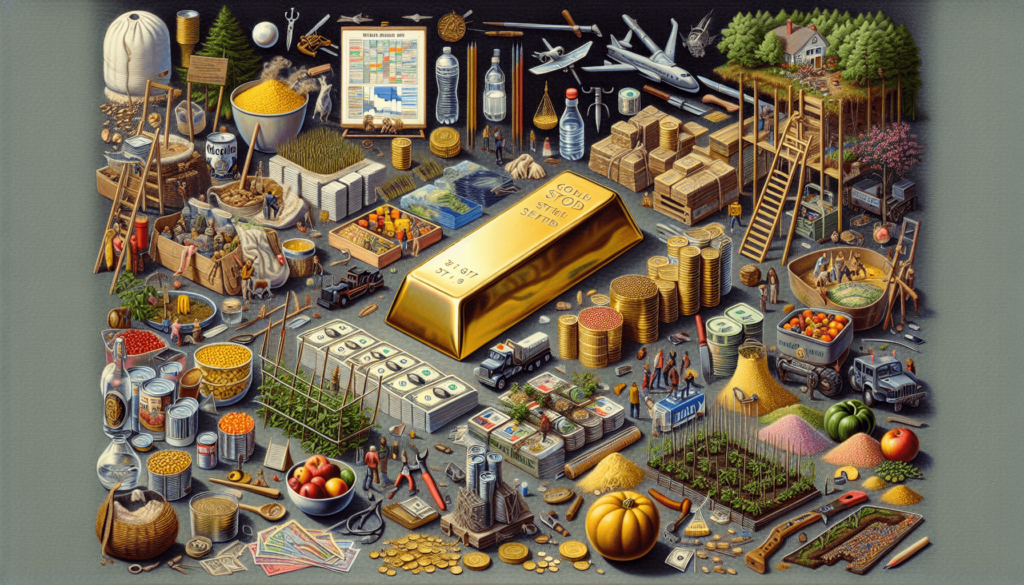

In times of uncertainty and societal collapse, it is important to have investments that hold tangible value. One such investment is gold and silver. These precious metals have been revered throughout history and are often seen as a safe haven during economic turbulence. Consider purchasing gold and silver bars or coins as a way to protect your wealth.

Another tangible asset to consider is land and real estate. Owning property not only provides a place to live but can also serve as a source of income through rental properties. Land is a finite resource, and its value tends to hold steady or even appreciate over time. Investing in land and real estate can provide stability and security during uncertain times.

Lastly, stock up on essential supplies and commodities. In times of collapse, access to basic necessities may become limited or even nonexistent. By stocking up on items such as food, water, and toiletries, you can ensure that you and your loved ones have the essentials needed to sustain yourself. Consider investing in non-perishable food items, water filters, and other supplies that may be crucial during a crisis.

Diversify your investments

Diversification is key when it comes to investing, especially during times of societal collapse. By spreading your investments across different asset classes, you can reduce the risk of losing everything if one sector were to fail. Invest in a mix of stocks, bonds, real estate, and commodities to create a well-rounded portfolio.

Additionally, allocate funds to a variety of sectors within each asset class. For example, if you choose to invest in stocks, consider investing in companies from different industries such as technology, healthcare, and consumer goods. This will help protect your investments from industry-specific risks.

Furthermore, consider international investments. While it is important to support your local economy, diversifying your investments globally can provide added protection. Investing in international markets can mitigate risks associated with a single country’s economic downturn and allow you to capitalize on opportunities abroad.

Build a self-sustaining lifestyle

Creating a self-sustaining lifestyle is crucial for surviving societal collapse. One way to achieve this is by creating a vegetable garden. Growing your own food not only reduces dependence on grocery stores but also ensures a fresh and healthy food source. Research and learn about sustainable gardening practices, companion planting, and seed saving to maximize your yields.

In addition to a vegetable garden, consider raising livestock for food production. Chickens, rabbits, or even goats can provide a steady source of protein even in times of crisis. Learn about animal husbandry and proper care techniques to ensure the health and wellbeing of your livestock.

Furthermore, it is essential to learn essential survival skills. These skills include first aid, foraging, hunting, and basic self-defense. Take classes or seek out resources to educate yourself and become self-reliant in various situations.

Establish multiple streams of income

In uncertain times, having multiple streams of income can provide stability and financial security. Consider starting a side business or freelancing in a field you are passionate about. This will not only provide extra income but can also serve as a backup plan in case of job loss or economic downturn.

Investing in income-generating assets is another way to establish multiple streams of income. This can include rental properties, dividend-paying stocks, or even online businesses. By diversifying your income streams, you can decrease your reliance on a single source of income.

Acquiring rental properties can be a lucrative long-term investment. By renting out properties, you can generate consistent rental income and potentially build wealth through property appreciation. Consider investing in properties that are in high-demand areas or have the potential for future growth.

Reduce reliance on the banking system

During societal collapse, the banking system may become unreliable. To protect yourself and your finances, it is important to reduce your reliance on banks. One way to do this is by keeping cash on hand. Having physical cash available can provide a means of exchange when electronic banking systems fail.

Investing in cryptocurrencies such as Bitcoin can also be a way to diversify your holdings outside of traditional banking systems. Cryptocurrencies are decentralized and operate on a secure blockchain network, making them resistant to government control and monetary policy changes. However, it is important to educate yourself about the risks and volatility associated with cryptocurrencies before investing.

Furthermore, store valuables in a secure location. Consider purchasing a safe or using a safety deposit box to protect important documents, precious metals, and other valuable assets. This will ensure that your wealth is protected in case of theft or other emergencies.

Become debt-free

Being debt-free is crucial during times of societal collapse. High-interest debts can quickly become a burden and limit your ability to respond to financial emergencies. Pay off any high-interest debts as soon as possible and avoid taking on unnecessary debt.

Utilize debt consolidation strategies to streamline your debt payments and potentially lower interest rates. This can include consolidating credit card debts, refinancing loans, or seeking debt counseling services. By reducing your debt load, you can free up more financial resources to invest in tangible assets and other necessary expenses.

Prepare for barter and trade

In the event of societal collapse, traditional forms of currency may lose their value. It is important to prepare for barter and trade by acquiring valuable bartering items. These items can include non-perishable food, water filters, medical supplies, and other essential goods that will be in high demand during crises.

In addition, learn negotiation and trade skills. Understanding the art of bartering and being able to negotiate fair trades can be invaluable during times of economic uncertainty. Practice your negotiation skills and develop a network of like-minded individuals who can collaborate on trading and resource sharing.

Invest in personal and community security

Personal and community security is of utmost importance during times of societal collapse. Invest in firearms and learn how to use them safely and responsibly. This can provide a means of protection for yourself, your loved ones, and your property.

Join community watch programs and collaborate with neighbors to enhance overall security. Establishing strong relationships with neighbors can create a sense of community and provide additional protection through shared resources and support systems.

Invest in measures to secure your home. This can include installing security systems, reinforcing doors and windows, and creating a plan for emergency situations. By taking proactive measures to enhance home security, you can protect both your physical and financial well-being.

Stay informed and adapt

To navigate the challenges of societal collapse, it is important to stay informed and adapt your financial strategies as needed. Follow reliable news sources that provide accurate and unbiased information. Stay updated on geopolitical events, economic trends, and any relevant news that may impact your financial situation.

Based on the information you gather, adjust your financial strategies accordingly. This may involve reallocating assets, diversifying investments further, or making changes to your self-sustaining lifestyle. Being adaptable and proactive in your financial decisions will help you stay ahead and navigate through uncertain times.

Seek professional financial advice

When facing societal collapse, seeking professional financial advice is highly recommended. Consult with a financial planner or advisor who can provide guidance on long-term financial planning and help you make informed investment decisions. They can assess your individual situation, goals, and risk tolerance to create a customized financial plan that aligns with your needs.

Ask for guidance on diversifying your portfolio and maximizing your investments. A financial advisor can provide insights into which asset classes and sectors may be most beneficial during times of crisis. They can also provide recommendations on specific investments and help you navigate the complexities of the financial markets.

In conclusion, preparing for societal collapse requires careful planning and strategic decision-making. By investing in tangible assets, diversifying your investments, building a self-sustaining lifestyle, establishing multiple streams of income, reducing reliance on the banking system, becoming debt-free, preparing for barter and trade, investing in personal and community security, staying informed and adaptable, and seeking professional financial advice, you can position yourself to withstand the challenges of an uncertain future. Remember, it is never too early or too late to start implementing these strategies and taking control of your financial well-being.